Visit Risk Scoring AML-CFT is a process that involves identifying, assessing and quantifying risks.

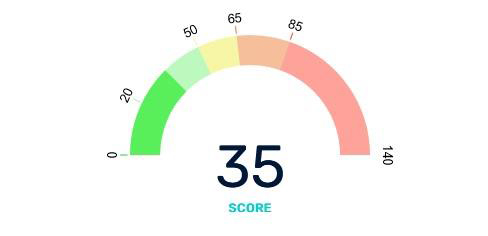

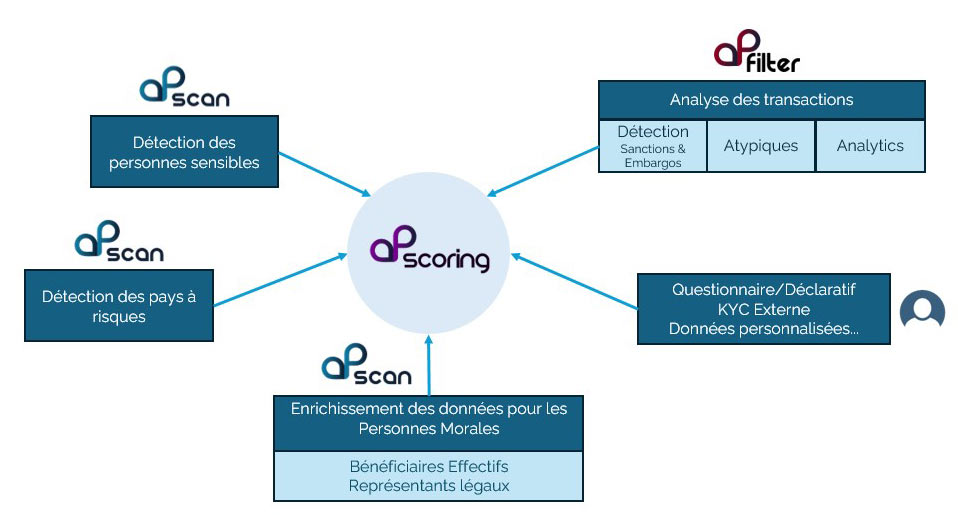

AP ScoringAugmented Augmented Intelligenceuses powerful algorithms to analyze customer data & financial transactions, toidentify and their level of risk by assigning scores.

Its automatic, continuous operation gives you dynamic risk evolution over time, as well as traceability and explicability by recording score evolution and changes.

Systematically assessing the risk AML-CFT of each customer allows you toautomatically adapt your due diligence at the start of the relationship and the reviews to be carried out throughout the customer relationship... to save invaluable time.

Lisk assessment has an impact direct on lead timestime-to-market and the effort requiredon your due diligence over time:

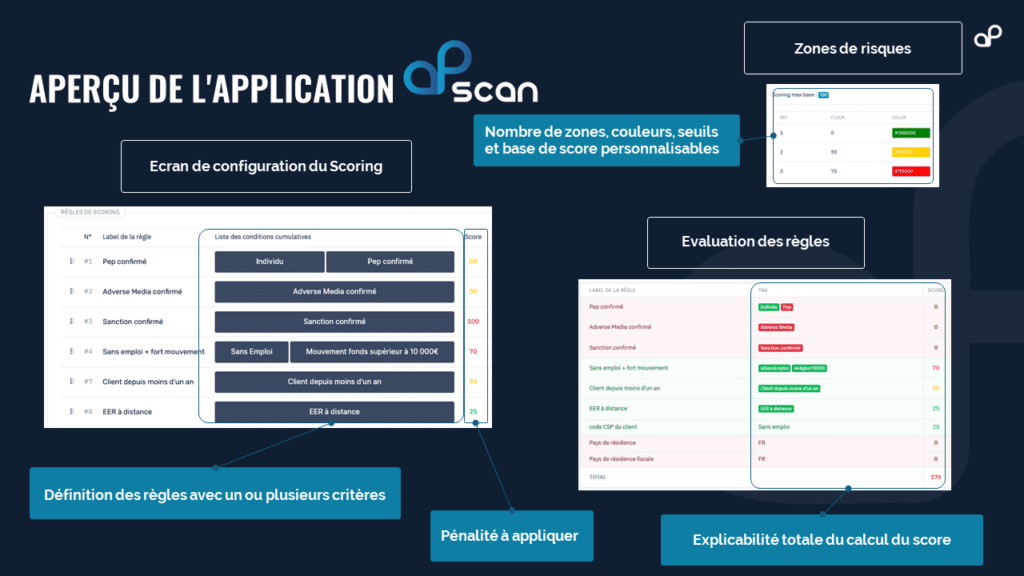

The rating calculated by the powerful algorithms d'AP Scoring corresponds to the sum of "weights" assigned à certain risk factors/indicators.

These factors/indicators can be grouped into 5 axes:

Nur tool and our teams accompany you step by step the configuration d'AP Scoring.

. To your current risk policy AML-CFT.

. All types of customer data available within your facility.

. To all your current and future Scoring scenarios, offering you agility, flexibility and versatility.

. Integration of screening results as Scoring input.

. Dynamic evolution of risk over time.

You define the rules yourself (NoCode).

. Generation and review of alerts in the event of changes customer score.

. Identifying risk factors.

. Total traceability and explicability.