Who we are

AP Solutions IO is a new-generation RegTech company offering Web, SaaS/API applications to combat money laundering and the financing of terrorism (AML-CFT), anti-corruption and export control.

Complying with current or future regulatory requirements is necessary, but extremely complex, costly and often time-consuming. A compliance tool worthy of the name must provide essential functionalities to enable effective validation of the entire AML* compliance system, and in particular the Know Your Customer* and transaction monitoring* measures imposed on companies.

*AML (Anti-Money Laundering) regulations are broad and far-reaching, covering all financial flows, regardless of border or time. In the European Union, its equivalent is the Fight against Money Laundering and Terrorist Financing (AML-CFT). The Know Your Customer(KYC) process involves verifying the identity and integrity of customers. European regulations require this verification in order to prevent corruption, money laundering, tax fraud and the financing of terrorism. Changes in the regulatory framework (EBA, Sapin 2, AML-CFT, etc.) require certain institutions to extend their knowledge of their suppliers (Know Your Suppliers - KYS). Transaction screening is an obligation AML-CFT aimed at checking that the customer's transaction is not subject to international sanction (counterparty under sanction) or trade embargo (restriction of activity for certain countries).

The founders of AP Solutions IO, historical experts in AML compliance issues, have observed that most of the solutions available on the market are not in line with the day-to-day needs of companies, in terms of :

- Productivity (user needs),

- Traceability & Explicability (regulators' needs),

- Fluidity & Speed of suspicion clearance (business needs).

...too complex to install, use and administer, these often incomplete tools are, in fact, reserved for financial experts and inaccessible to Intermediate-Sized Companies (ME) and Small and Medium-sized Enterprises (SMES).

Recognizing the difficulties companies have faced in constantly reshaping their systems and business processes to keep pace with the expanding regulatory landscape, AP Solution IO has seized the opportunity to offer powerful, state-of-the-art compliance tools. They effectively assist regulated organizations to handle 100% of legal requirements more efficiently, more cost-effectively, with greater flexibility and adaptability to recurring changes in regulations & corporate Information Systems.

With our IO Saas/full API systems, the barriers to entry are low and the cost of operation particularly economical(full service subscription). Our tools integrate with all types of existing customer or third-party files in the company's information system.

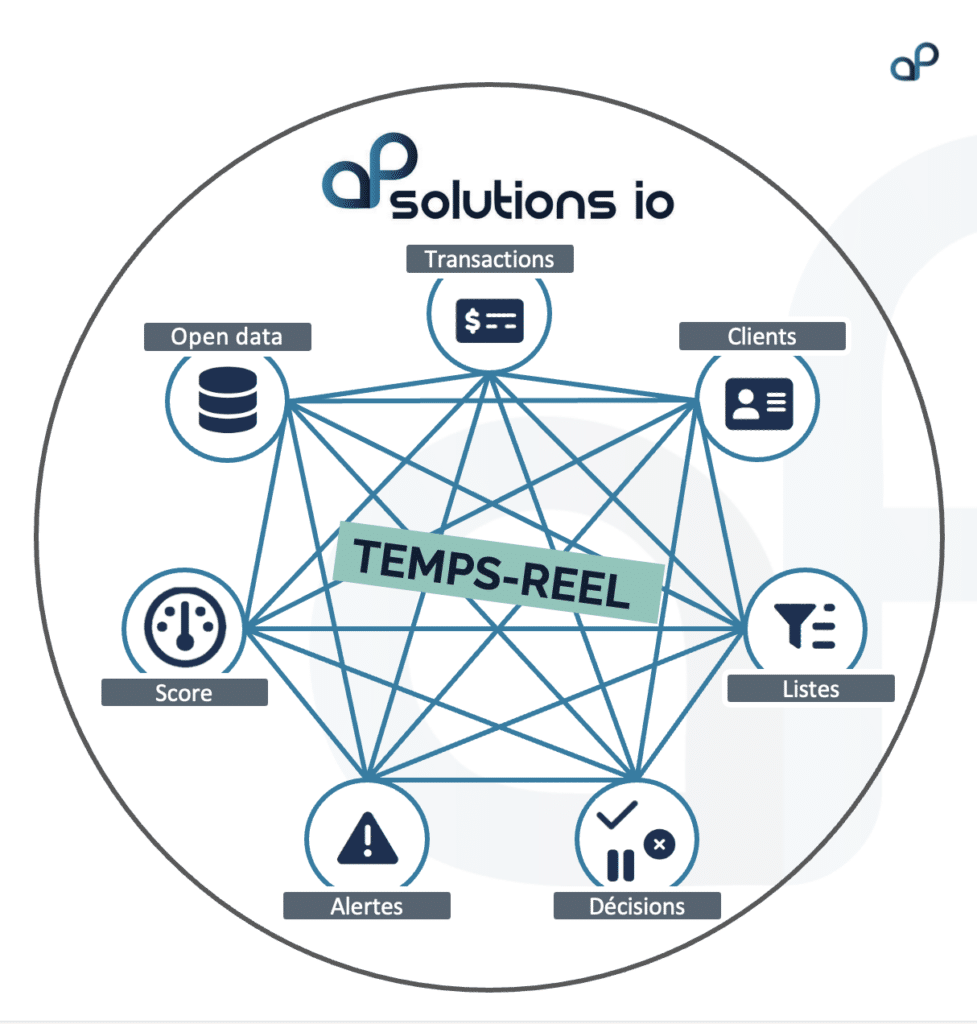

Our scope of action: Filter, Detect & Process counterparties vis-à-vis "listed entities": Global/Regional Sanctions, Asset Freezes, Politically Exposed Person, RCA(Relatives and Closes Associates), Unfavorable Media, Beneficial Owners, identification of Countries and Currencies under embargo, internal lists, Dow Jones, Acuris, Open Data (INPI, ORIAS, deceased persons...) with an optimization of the reporting process and a drastic reduction in the handling of suspicions . We adapt to your risk appetite, whatever the size of your company or the regulatory requirements you face.

100% target Regulatory Compliance with drastically reduced processing time, thanks to a formidable end-to-end automated detection and reduction engine, with over 70 reduction criteria and real-time response! Our long-standing expertise enables us to keep a regulatory watch to anticipate future constraints and ensure that current ones are under control.

Two interconnectable solutions

AP Scan for third-party screening - AML & KYC Screening

Optimize and automate the detection, identification, classification & processing of sanctioned or sensitive individuals or companies.

AP Filter for filtering financial transactions - Transaction Screening

Detection of international sanctions and/or identification of countries and currencies under embargo.

Faced with social and environmental concerns, our organization has opted for 100% Full Remote and eco-responsible Datacenters based in France.

Thanks to its historical expertise and agility, and the performance and power of its tools, AP Solution IO has already attracted a number of prestigious customers in fields as varied as Banking - Asset Management - Financial Organizations, Insurance, Provident Funds, Mutual Insurance Companies & Brokers, Online Gaming, Gift & Restaurant Vouchers... AP Solutions IO meets the needs of all companies, whatever their size(Key Accounts, ME or SMES): Real Estate, Numbers, Lawyers, Notaries, Domiciliary Companies, Merchant Sites...the majority of companies, large or small, are today concerned by the regulations.

Founders' historical experience

Patrice Bedikian

CO-FOUNDER & CTO - CAMS CERTIFIED

A former CTO at Arval Service Lease, Patrice has specialized in compliance since 2005.

Patrice was Product Manager of Safewatch for SIDE Eastnet, then of Firco Continuity for FircoSoft for 6 years, before heading 4 departments.

He has joined BNPParibas as head of group financial security tools until 2019 to handle transaction filtering, OnBoarding controls and customer screening.

He liaised with French and American regulators and ICs* to implement remediation plans.

Patrice is in charge of Product, Architect and IT Development.

Patrice has been CAMS** certified since 2016

* IC: Independent Consulting

** CAMS: international certification recognized by financial institutions, governments and regulators in the field of sanctions, embargoes and anti-money laundering.

Aurélien Zachayus

CO-FOUNDER & CEO

Aurélien worked in the banking and insurance sectors and at Fircosoft on the Firco Continuity and Firco Utilities products before taking charge of the Business Analysis department.

He was an expert consultant on filtering and screening tools at BNPParibas and manager of the team responsible for filtering the group's cross-border transactions.

Aurélien has also worked as a consultant for a number of European banks and financial institutions as a banking compliance tools expert, helping them to implement applications, processes and methodologies.

Aurélien is President, Product, Design & Testing.