Become an expert in detecting suspicious transactions

AP Scoring for a unique compliance service

AP Scoring

AML-CFT Risk Scoring is a process that involves identifying, assessing and quantifying risks.

AP Scoring, an Augmented Intelligence engine, uses powerful algorithms to analyze customer data & financial transactions, in order to identify and rate their level of risk by assigning scores.

Its automatic and permanent operation offers you dynamic risk evolution over time, as well as total traceability and explicability by historizing score evolution and changes.

By systematically assessing the AML-CFT risk of each customer, you can automatically adapt your due diligence at the start of the relationship and the reviews to be carried out throughout the customer relationship... saving invaluable time.

- Automate your due diligence

- Time-saving and efficient

- Improved decision-making

- Strengthening compliance

- Total control of your risks

- Hosted in France

Risk assessment has a direct impact on the time it takes to enter into a relationship, and the effort you have to put into your due diligence over time:

- List of additional supporting documents to be requested, actions to be implemented: appointment, questioning of the relationship...

- Application validation workflow: Automatic, human intervention, 4-eyes validation...

- Frequency of customer review, which depends on the level of risk assigned: 5 years for low, 3 years for medium, 1 year for high...

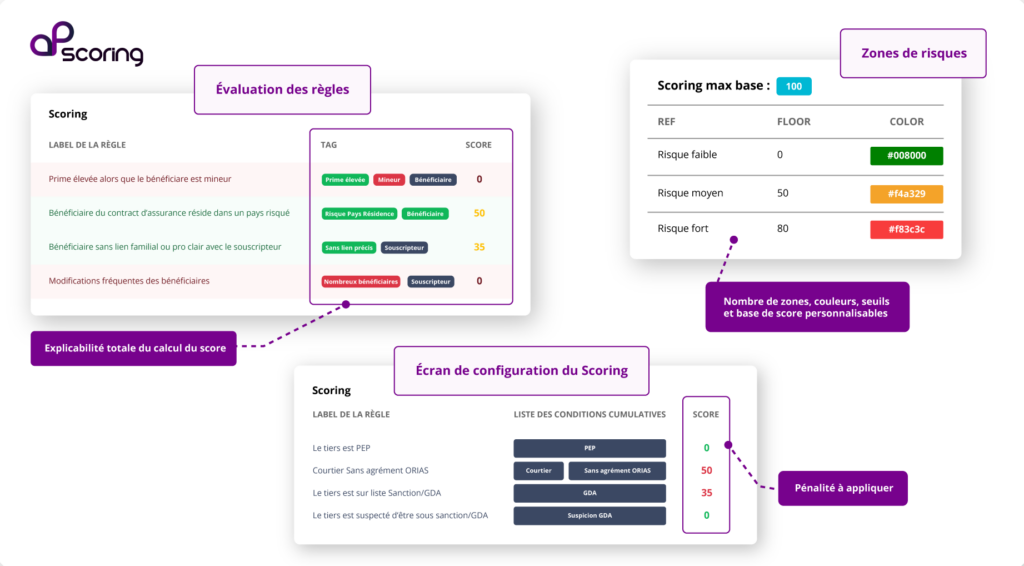

The rating calculated by AP Scoring's powerful algorithms corresponds to the sum of "weights" assigned to certain risk factors/indicators.

These factors/indicators can be grouped into 5 axes:

- Customer characteristics (CSP, sanctions Assets Freeze, PEP, AME, PP, PM...),

- Distribution channels used,

- Nature of products or services offered,

- Transaction conditions offered/Conditions of completion,

- Geographical factors.

Perfect adaptability

To your current AML-CFT risk policy, to all types of customer data available within your establishment, and to all your current and future Scoring scenarios, offering you agility, flexibility and adaptability.

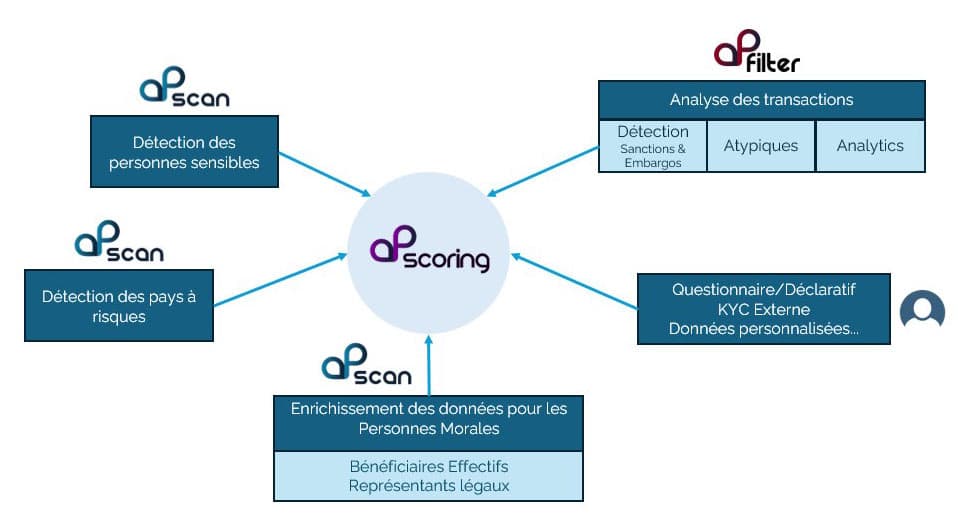

Real-time correlation

Integration of screening results as Scoring input, and dynamic risk evolution over time.

Total control of your risks

You define the rules yourself (NoCode), generate and review alerts in the event of changes in customer score, identify risk factors, and ensure full traceability and explanability.