Control your compliance processes AML-CFT and KYC

Accelerate your controls and streamline your compliance, thanks to our technology enhanced with Augmented Intelligence.

100% digital solution

Data protection

Optimized costs

Key market figures

Today, digitalization affects every industry. The fight against financial crime has never been more topical, and compliance has never been more necessary. It's becoming easier and easier to hide your identity. Identifying risks is increasingly difficult.

From a financial point of view

From a global perspective

From a regulatory standpoint

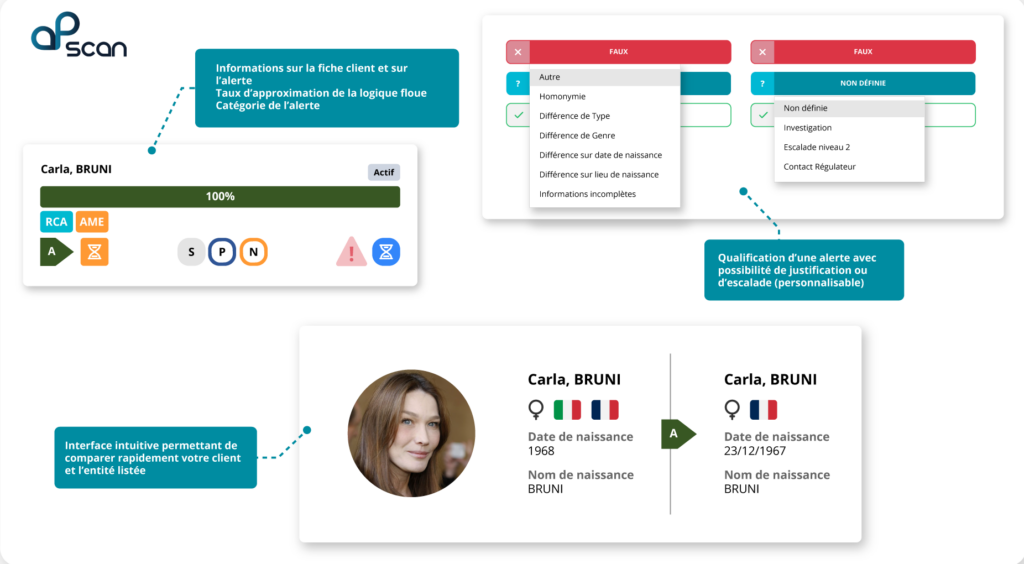

AP Scan

Remain compliant with regulatory obligations to detect sensitive persons and automate your entire detection process, while keeping control of your alert management.

- SaaS and full API

- Easy to integrate

- Flexible and scalable

- Real-time results

- Latest-generation reduction motor

- Hosted in France

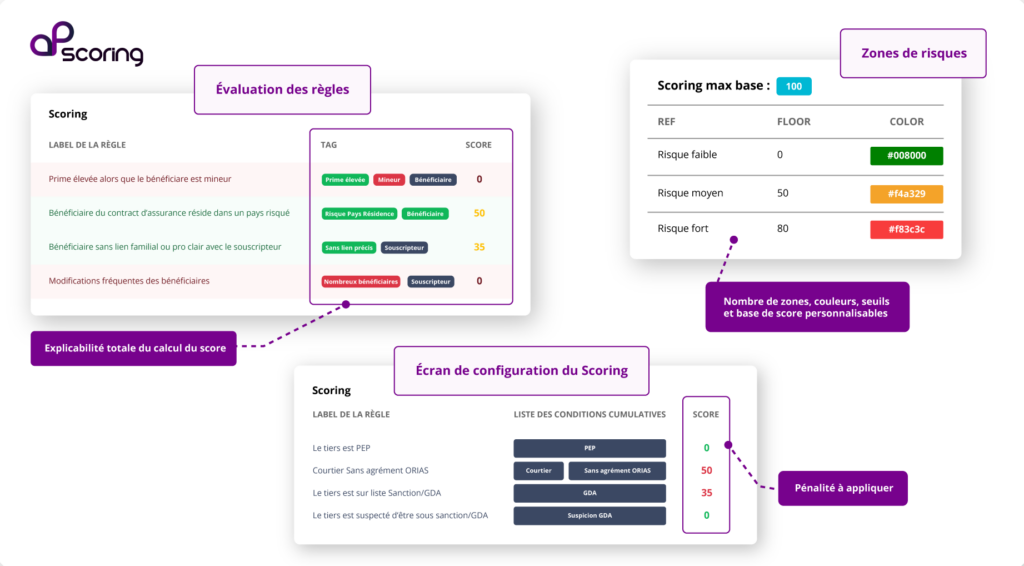

AP Scoring

Analyze your customer data and their financial transactions with our Augmented Intelligence engine to identify and rate their level of risk.

- Automate your due diligence

- Time-saving and efficient

- Improved decision-making

- Strengthening compliance

- Total control of your risks

- Hosted in France

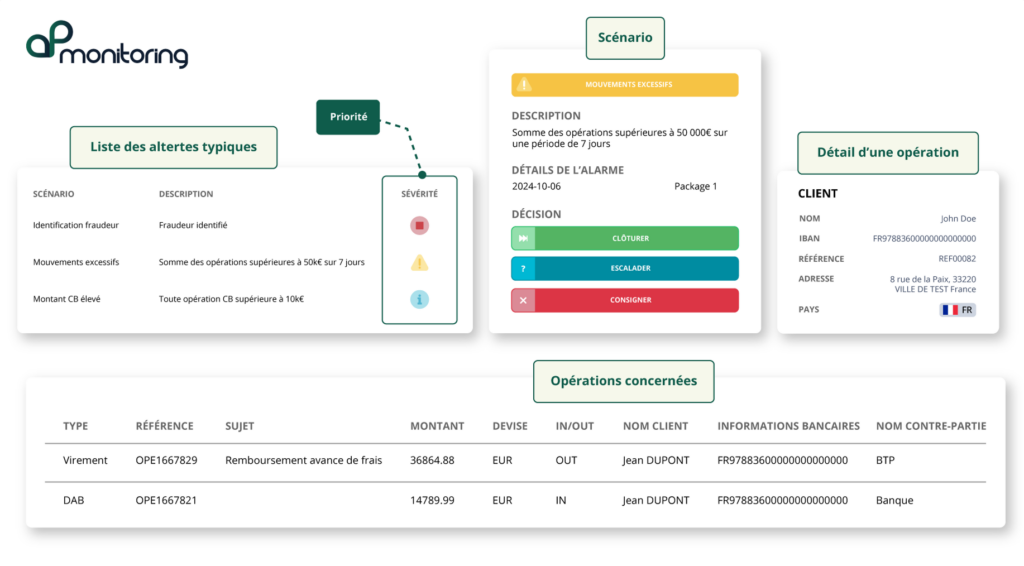

AP Monitoring

Identify, monitor and report suspicious transactions in real time with AP Monitoring, a powerful engine enriched with augmented intelligence, enabling continuous monitoring of atypical or unusual transactions.

- Detecting and reducing fraud attempts

- Easily configurable scenarios

- Prioritizing alerts

- SaaS and full API

- Continuous system improvement

- Hosted in France

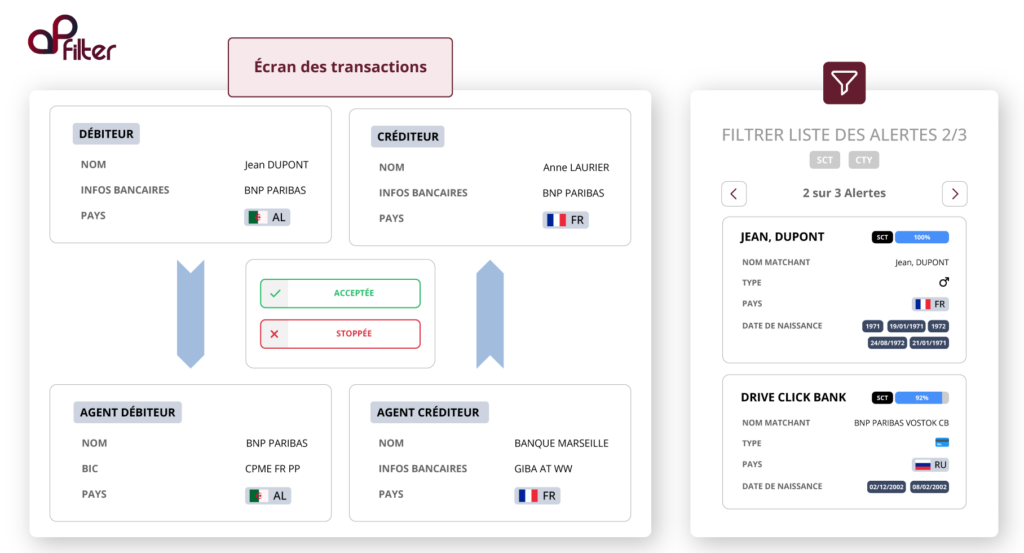

AP Filter

Remain compliant with regulatory obligations concerning the detection of international sanctions and the identification of countries and currencies under embargo.

- SaaS and full API

- High performance, even with large volumes

- Optimized interface

- Turnkey

- Compatible with ISO20022, MT...

- Hosted in France

Latest-generation technology

Detection and reduction intelligence, perfectly traceable and explainable.

High-performance KYC-KYS and AML-CFT solutions

Over 90 discount criteria and real-time response.

Unlimited integration

Web, SaaS and native API interfaces, plus trilingual tools.

Historical market expertise

Active in the compliance market for over 15 years

Our certifications

We're proud to be able to point to the road we've travelled as one of the richest we've ever achieved. Finalist in competitions, nominated as one of the world's best solutions AML-CFT or a favorite among detection tools. These multiple awards encourage us to continue improving the performance of our tools, so as to meet every challenge!

Synergy of human and technological prowess

Our technology provides enhanced detection intelligence, with drastically reduced processing times, thanks to an end-to-end automated detection and reduction engine. Enhanced by an unprecedented level of granularity, our solutions provide you with real-time responses that are always traceable and explainable. In the event of internal or regulatory due diligence, you can systematically justify total transparency.

They strengthen our ecosystem

To go even further in the fight against financial crime, the collaborations we have forged with our partners are essential principles.

Together, we enrich our solutions in the service of your compliance.

Our latest news

Discover our latest articles on KYC, AML-CFT, anti-corruption and Export-Control compliance, and access our practical advice on how to optimize your processes and protect yourself against risks.

Le vrai coût de la non-conformité en 2025

Episode 1 – Fraudes et opérations suspectes en 2025 touchent tous les secteurs

KYT : quand la Regtech optimise la vérification des transactions

They say it best

FAQ

Are the tools turnkey?

Our all-in-one tools can operate in complete autonomy and be used by non-expert users. They can be connected to your information system via our APIs, or operate in hybrid mode with the simultaneous use of our APIs and our web portal.

Are the tools compatible with my organization?

Thanks to over 90 parameter criteria, our tools can be configured according to your compliance policy and risk appetite. They are available from any location, in French, English and Spanish, with the possibility of adding other languages on request.

Do the tools evolve with my needs?

AP Solutions IO delivers a new version of the application every 4 months. Thanks to our SaaS mode, you automatically benefit from these upgrades without any action on your part. We are always ready to listen to your specific needs.

Are the tools conform GDPR ?

Our tools comply with GDPR standards, and make cybersecurity a top priority, with annual penetration tests carried out by independent experts. Our APIs are designed using REST/JSON standards and secured by OAUTH2. Our no-code solutions enable quick and easy evaluation, while our advanced security measures ensure data integrity, confidentiality and traceability.