Become an expert in

regulatory compliance

One-stop compliance solutions

Our risk detection solutions

AP Solutions IO's tools enable you to remain compliant, even as your business and regulations evolve, thanks to 100% digital solutions created with data protection in mind and optimized costs.

What do we do?

Why is it good for you?

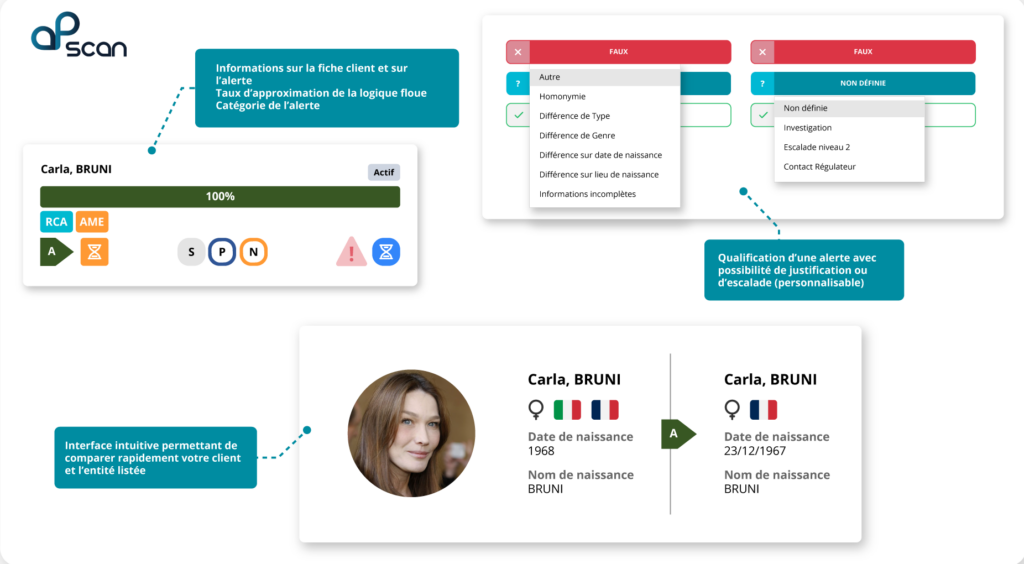

AP Scan

AP Scan enables you to automate your entire detection process and facilitates alert management, so that you remain compliant with regulatory obligations to detect sensitive persons (Sanctions, Asset Freezes, PEP and their relatives, reputational risks, Country risks...).

- Saas and full API

- Easy to integrate

- Flexible and scalable

- Real-time results

- Latest-generation reduction motor

- Hosted in France

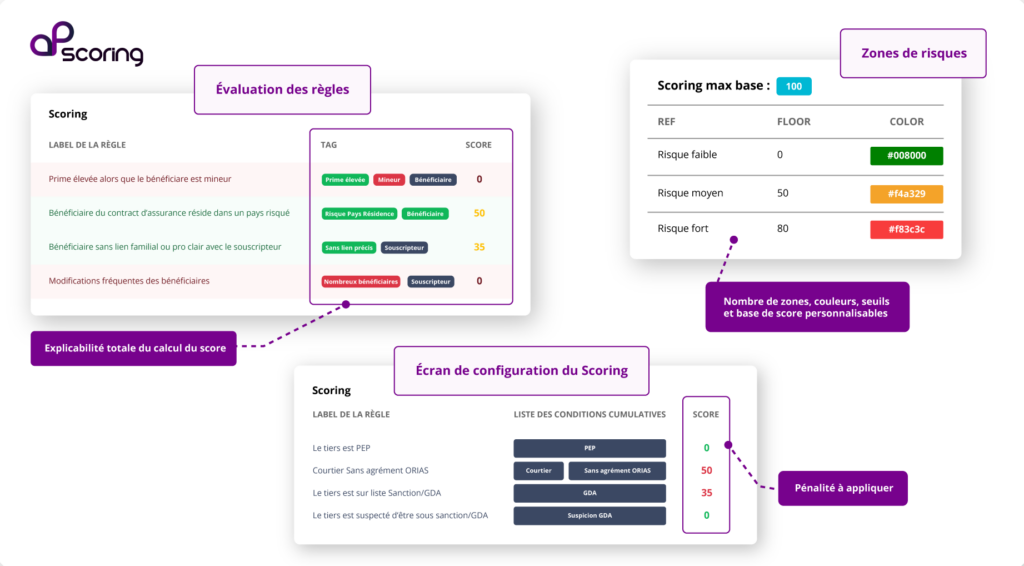

AP Scoring

AP Scoring, an engine enriched with augmented intelligence, uses powerful algorithms to analyze customer data and their financial transactions or operations, in order to identify and rate their level of risk by assigning scores.

- Automate your due diligence

- Time-saving and efficient

- Improved decision-making

- Strengthening compliance

- Total control of your risks

- Hosted in France

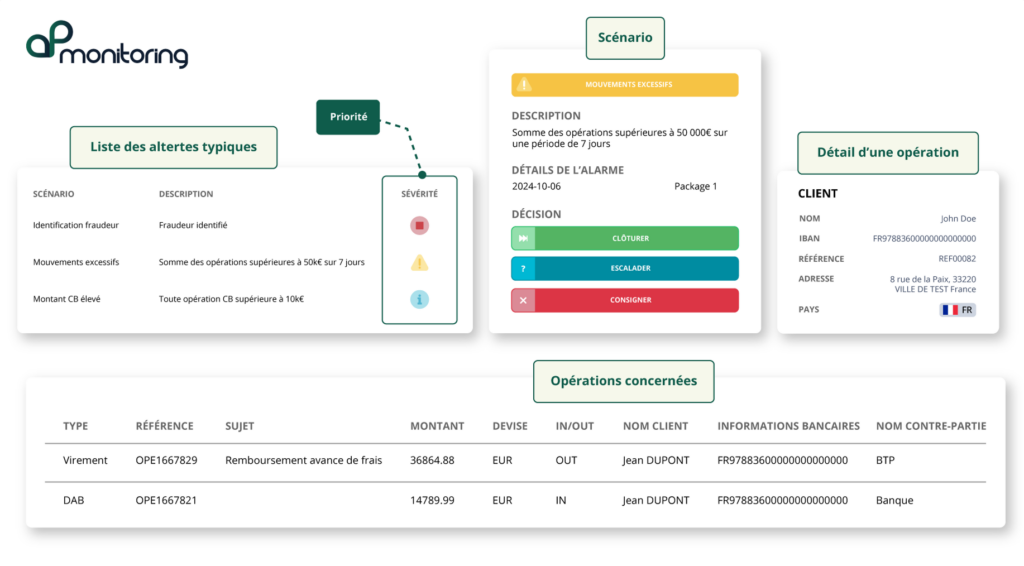

AP Monitoring

AP Monitoring enables you to continuously monitor atypical or unusual transactions to protect you from money laundering or fraud schemes that are difficult to spot manually.

- Detecting and reducing fraud attempts

- Easily configurable scenarios

- Prioritizing alerts

- SaaS and full API

- Continuous system improvement

- Hosted in France

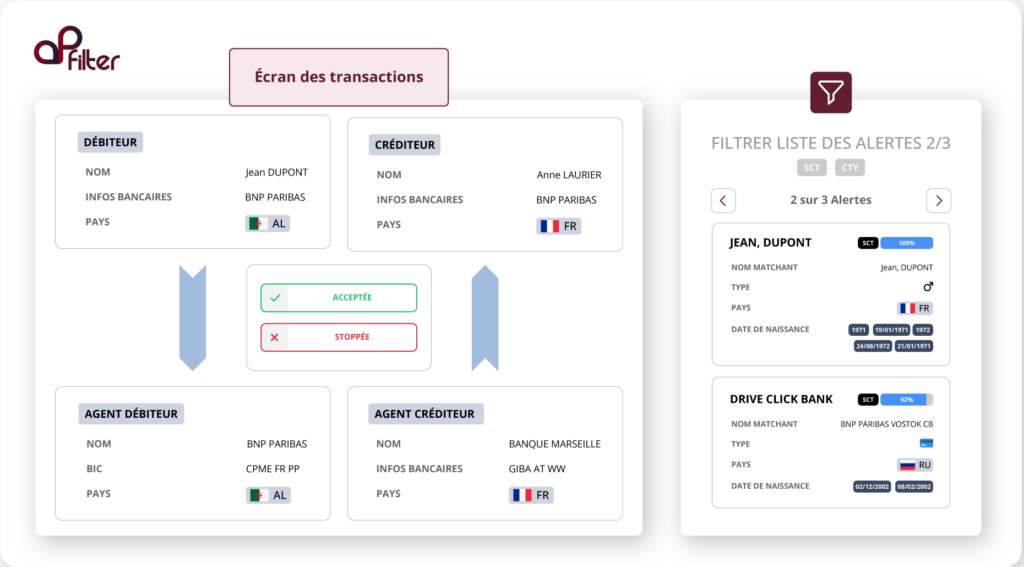

AP Filter

AP Filter gives you instant detection to help you comply with regulatory requirements concerning the detection of international sanctions and the identification of countries and currencies under embargo.

- SaaS and full API

- High performance, even with large volumes

- Optimized interface

- Turnkey

- Compatible with ISO20022, MT...

- Hosted in France

Setting compliance criteria

Use our tools according to your needs! Meet the expectations of the supervisory authorities in your sector, thanks to the adaptability of our tools. Customize them according to your subsidiary or territory to achieve a significant reduction in alerts.

Climbing workflow

Customize your decision workflow according to your desired levels of investigation, enter comments and add attachments for optimal follow-up.

Reporting

Create tailor-made reports for analysts, operational managers, management, ... we cover all your needs.

Contractual flexibility

12-month commitment with free cancellation within the first 3 months. We also include a start-up kit lasting several days, so you can get off to a flying start.

FAQ

How does third-party identity verification and data enrichment work?

Third-party identity verification and data enrichment are based on a preventive assessment of data integrity, including the collection of information (name, nationality, SIREN, etc.) and supporting documents. APScan detects sensitive persons (sanctions, PEP, Adverse Media) using fuzzy logic and 90+ parameters to reduce false positives. It enriches data by identifying Beneficial Owners, verifying their compliance with the Sapin II law, and validating information such as the Orias number.

Can the tools be used to segregate user roles and profiles?

Our tools enable you to have both standard and administrator users. It is also possible to define perimeters and domains for each user.

For example: You have several branches. Each user only has access to the files for their own Agency. It is not possible to view the records of other agencies. You can set up profiles for each piece of information/action in the application.

Do the solutions generate tailor-made reports, adapted to each of my organization's profiles?

Our solutions offer several types of "off-the-shelf" reports, as well as creating new ones on demand. This means you can have reports tailored to your needs.

Can AP Solutions IO tools meet compliance obligations without slowing down customer journeys?

Our detection engine offers outstanding detection quality thanks to extremely precise parameterization, resulting in fewer "false positives". Fewer alerts to review, fewer doubts.