On June 29, 2023, the ACPR published a new version of the ASR: Analyse Sectorielle des Risques de Blanchiment de Capitaux (BC) et de Financement du Terrorisme (FT).

The purpose of the RSA is to help supervised institutions map the risks to which they are exposed; it also helps guide the ACPR' s anti-money laundering and combating the financing of terrorism control activities (AML-CFT).

ACPR presents :

- Visit main threats based on on objective indicators

- Risk of proliferation

- Corruption

- Environmental Crime

- National Risk Analysis :

- Visit mitigation measures to determine the level of residual vulnerability

- Anonymizing products

- Risks of fraud and identity theft

- Cybercrime

- Geographical risks

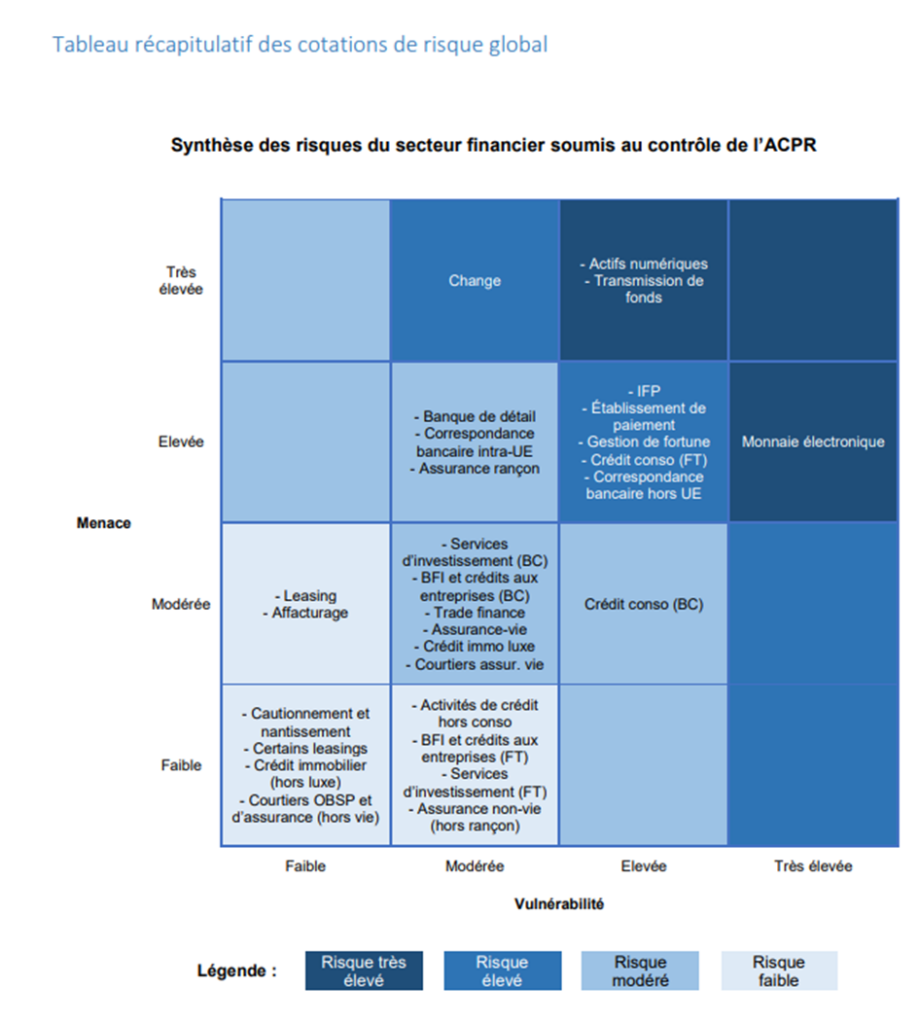

By cross-referencing Threats and Vulnerabilities, we canidentify the overall level of risk for each sector/product:

Note : New risk rating level: VERY HIGH, in addition to previous levels: Low, Moderate, High)

Find out more about ASR below: