Regtech solutions for optimal regulatory compliance

The pillars of our solutions

The founders of AP Solutions IO, historical experts in AML compliance issues, have observed that most of the solutions available on the market are not in line with the day-to-day needs of companies, in terms of :

Productivity

Traceability and explicability

Smooth and rapid removal of suspicions

Handle 100% of requirements

Today's compliance tools are complex and expensive, often inaccessible to ME and SMES. Recognizing the difficulties companies face in constantly reshaping their processes to keep pace with new regulations, AP Solutions IO has seized the opportunity to offer powerful, state-of-the-art compliance tools.

Our tools cover all regulatory requirements: filtering, detection and processing of listed entities (sanctions, PEP, adverse media, Beneficial Owners, etc.), while reducing suspicions and optimizing reporting, all thanks to a subscription including all the necessary services.

With an automated engine using over 90 reduction criteria, we offer fast processing and proven compliance. Our expertise guarantees anticipation of regulatory changes and ongoing control of constraints, so as to guarantee your peace of mind and avoid any unpleasant surprises.

Anticipating future constraints

Active in the AML and AML-CFT compliance market since its inception, the founders of AP Solutions IO benefit from years of experience in producing next-generation systems to meet the ever-changing needs of the market.

AML-CFT Compliance, Anti-Corruption, Anti-Fraud, Export-Control... our expertise and knowledge of the industry enable us to keep a close eye on regulations to anticipate future constraints, and to offer tools for total mastery of current constraints.

Accessible compliance

With our full API SaaS application, we're pushing back the barriers, and keeping operating costs low. It's easy to use and intuitive to use!

For whom?

Companies subject to AML-CFT regulations, Key Accounts, ME & SMES, such as banks, credit institutions, Banque de France, issuing institutions, investment companies, real estate professionals... See more

Full service subscription

Billing is based on the number of names filtered, regardless of the number of queries on a given name. The 12-month, renewable subscription offers a free exit option for the first 3 months.

Hidden costs

No license fees, no set-up costs, and an unlimited number of users! A starter kit is included in our offer, and the subscription includes automatic updates and new versions at no extra cost.

Scalability

Our tools enable us to handle large volumes and adapt to your changes.

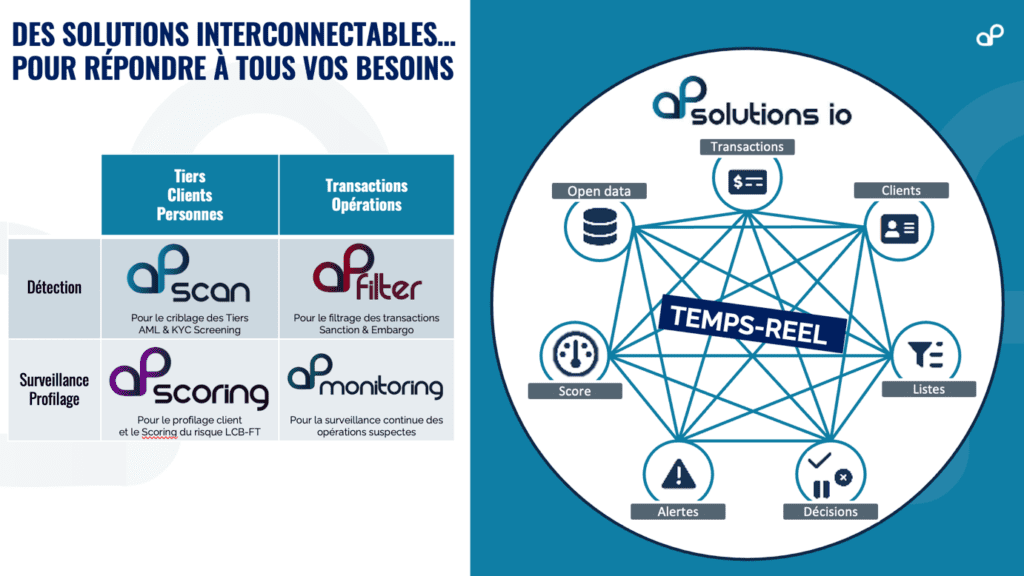

Our interconnectable tools

Our tools handle a wide range of requirements, while remaining interconnectable to meet all your regulatory challenges.

AP Scan - Third-party screening

Optimize and automate the detection, identification, classification and processing of sanctioned or sensitive individuals or legal entities.

AP Filter - Filtering financial transactions

Detection of international sanctions and/or identification of countries and currencies under embargo.

AP Scoring - AML-CFT risk assessment

Risk identification, assessment and quantification solution, enriched with Augmented Intelligence, to analyze customer data and financial transactions.

AP Monitoring - Operations identification

Real-time identification, monitoring and reporting of suspicious transactions, with all types of scenarios.

Faced with social and environmental concerns, our organization has opted for full remote access and eco-responsible datacenters based in France.

Thanks to its expertise and agility, AP Solution IO has already attracted a number of prestigious customers in fields as varied as banking, asset management, financial organizations, insurance, provident funds, mutual insurance companies and brokers, online gaming, gift and restaurant vouchers and much more.

From an industrial standpoint, AP Solutions IO meets the needs of all companies, whatever their size. Indeed, the majority of companies, large and small, are today concerned by regulations.

FAQ

What is AP Solutions IO's Augmented Intelligence?

AP Solutions IO's Augmented Intelligence combines human, collective and artificial intelligence to guarantee traceable, explainable and legitimate decisions, in line with the requirements of AML-CFT regulators. Unlike conventional AI (Black Box), it favors a transparent approach (Glass Box), where every recommendation is based on justifiable rules. It automates repetitive tasks, reducing false positives by up to 98%, while securing and accelerating flow analysis for optimal risk-adjusted compliance.

Are the tools flexible and scalable to my needs?

AP Solutions IO tools are flexible and scalable, with automatic updates every 4 months via the SaaS mode included in the subscription. This model gives you access to the latest enhancements without any intervention on your part. What's more, we're always ready to listen to your specific needs and adapt to your requirements on an ongoing basis.

Are search engines and the updating of international sanctions lists also controlled by regulators?

Yes, list management is of course controlled by the supervisory authorities:

- In terms of the perimeter used,

- Update frequency,

- Time for re-screening relationship entries (EER) and customer portfolio.

In addition to the search engine, the entire compliance system is audited by the regulators. This must be fully aligned with the company's "theoretical" compliance policy, hence the need for a flexible, configurable tool, but above all precise and complete traceability and explicability.

Can the tool automate decisions? Can it be configured so that my "theoretical" compliance policy corresponds to my company's "field" operational reality?

Our tools automate decisions thanks to over 90 parameterization criteria, enabling you to precisely align your "theoretical" compliance policy with operational reality. They reduce the number of alerts to be processed, optimizing HR costs and speeding up approvals to make business run more smoothly.