Last summer, the FATF (Financial Action Task Force) updated its risk-based approach guidelines for the real estate sector. These guidelines, issued by the intergovernmental anti-money laundering and combating the financing of terrorism organization (AML-CFT), are intended not only for real estate professionals, but also for all those subject to the French anti-money laundering and combating the financing of terrorism regime (professionals mentioned in article L. 561-2 of the CMF ). Today, some 200,000 professionals in France are subject to the French anti-money laundering and combating the financing of terrorism regime) to re-establish a proper understanding of their obligations at AML-CFT.

At the same time, TRACFIN (the French intelligence service responsible for combating money laundering and the financing of terrorism, as well as tax, social security and customs fraud. Attached to the Ministry of the Economy and Finance) publishedits annual activity report and analysis.

In this article, we'll look at the main points to remember from these two publications.

Whether it's the FATF or TRACFIN, everyone reiterates that real estate is an area that facilitates money laundering, as the proceeds of fraud and/or criminal activities can be integrated into the real economy. The dynamism of the real estate market and the diversity of its players expose it to a risk of money laundering that requires constant vigilance on the part of professionals subject to the AML-CFT law.

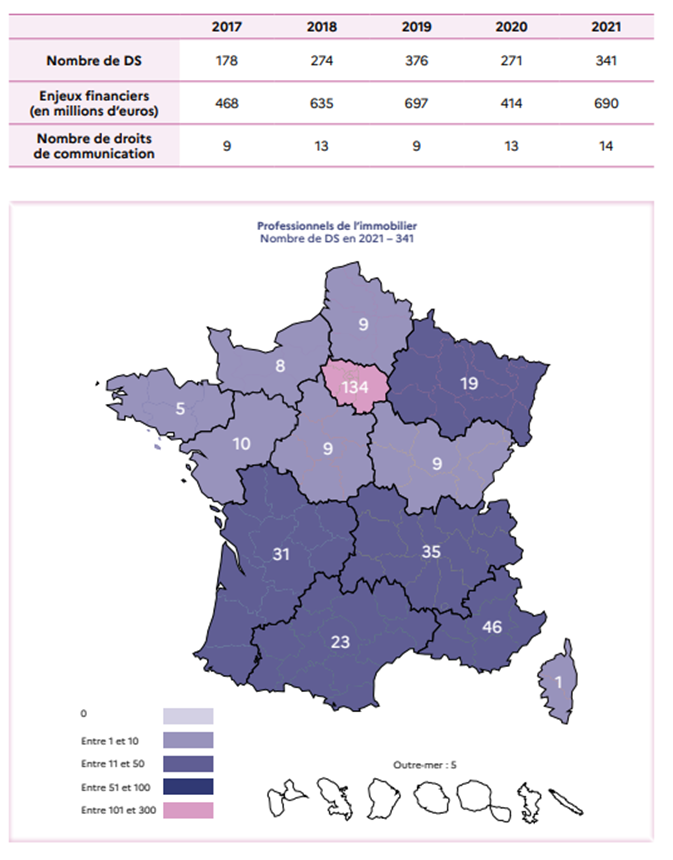

Despite an increase in suspicious transaction reports from the real estate sector in 2021 (341 SARs) compared with 2020 (271 SARs), the number remains below the figures achieved in 2019 (376 SARs). TRACFIN strongly points to the under-representation of reporting activity in the real estate sector compared to the dynamism of the French real estate sector: more than 1,300,000 real estate transactions carried out in 2021 for a value of around €310 billion.

TRACFIN also notes a significant geographical imbalance in the number of suspicious transaction reports:

- The vast majority of DS are from the Ile de France, Var and Alpes Maritimes regions.

- 7 départements (Paris, Hauts-de-Seine, Alpes-Maritimes, Essonne, Var, Gironde and Yvelines) account for almost half the DS workforce

- More than half of France's départements have not transmitted a single DS

source: TRACFIN

What is a suspicious transaction report?

Article L. 561-15 of the CMF imposes a reporting obligation on all regulated professionals. Declarations of suspicion are sent to TRACFIN and constitute the raw material on which the department works. They concern sums or transactions involving sums which financial organizations know, suspect or have good reason to suspect originate from an offence punishable by a custodial sentence of more than one year, or are linked to the financing of terrorism. This declaration must be made before the transaction is executed or carried out. Only in exceptional cases and under specific circumstances may the professional submit a suspicious transaction report after the transaction has been carried out or completed. Attempted transactions must also be reported to TRACFIN. Article R. 561-31 of the CMF specifies the content of the suspicious transaction report.

Source: TRACFIN

However, according to the ANR (Analyse Nationale des Risques AML-CFT), real estate activities in France, due to the dynamism of the sector, the size of the financial amounts involved and the security offered by real estate investments (especially in major cities and tourist areas), are extremely exposed to a high threat of money laundering and terrorist financing.

Real estate professionals have been subject to AML-CFT obligations since :

- 2009 for their buying and selling activities

- 2014 for their condominium management business, then exempted from the obligations following the 2020 ordinance

- 2016 for their rental business

Which real estate players are involved?

All players in the real estate sector are exposed to the laundering of the proceeds of offences of all kinds, such as corruption, concealed work, drug trafficking, tax fraud and swindles:

- public or private,

- individuals or professionals

- real estate agents,

- franchisors & franchisees,

- real estate agents,

- independent,

- exclusive representative (or not) of the buyer and/or seller

- property dealers,

- real estate developers,

- collaborative platforms,

- real estate brokers,

The FATF reminds us that all professionals likely to carry out, prepare or participate in real estate transactions directly or indirectly on behalf of clients must also comply with these obligations:

- lawyers,

- notaries,

- banks,

- insurers,

- other independent legal professionals,

- accountants,

- auctioneer

- etc.

In short, all the professions covered by the FATF's AML-CFT and national obligations.

However, it is made very clear that all parties are individually responsible for fulfilling their obligations, and that it is not possible to delegate or rely on another party involved in a real estate transaction not to carry out the required due diligence.

The FATF requires real estate professionals involved in transactions to adopt these measures in the same way as required of other reporting entities. This requirement is intended to mitigate shortcomings resulting from incomplete implementation of due diligence requirements and the inability of reporting entities to adequately apply AML-CFT.

All types of property are covered by these obligations: residential, commercial, agricultural, industrial, rural and others.

The risk of money laundering also comes into play at every stage in the life of a real estate project:

- before the construction of a property: when applying for a building permit or awarding public property contracts (payment of cash to a corrupt public official, for example);

- during the property construction phase: injection of cash from illicit activities (drug trafficking, fraud, tax evasion, etc.) to pay for raw materials or undeclared workers on building sites;

- during real estate transactions or leases: real estate kickbacks, complex arrangements aimed at integrating funds transiting through jurisdictions facilitating the concealment of the origin of funds and the identity of Beneficial Owners the purchasers of real estate in France, payment of rents in cash, etc. ;

- obtaining a property loan: facilitating the granting of a loan by a bank officer who modifies the borrower's file favorably.

FATF's extreme illustration of how indicators can arouse suspicion in residential real estate:

Jane Doe (who was considering a purchase) contacted real estate broker Mary Smith to inquire about two properties. Jane said she worked as a waitress in a restaurant. Mary researched both properties and sent Jane an e-mail with pros and cons for each. They made an appointment for viewings.

On the day in question, Jane notified Mary by e-mail that she was unable to attend due to illness, and that in any case she had already decided to purchase the property at $800,00. Jane explained that she was in the midst of a custody battle with her ex-spouse and was in a hurry to buy a house to demonstrate that she was capable of housing her children.

Mary was slightly surprised by his choice of the most expensive property and his willingness to buy without first viewing the house or having someone else inspect it first. [Suspicion trigger: speed of transaction, inconsistency].

Concerned by this choice, Mary pointed out that the sale price was overvalued by $50,000 and that she was well placed to take advantage of this by making an initial offer below the asking price, but that in any case, it would be important for Jane to visit the house to make sure it met her needs. Jane e-mailed Mary to let her know that, given her pressing need to find a home for her children, she had already made up her mind and asked Mary to match the seller's initial asking price. [Escalation of Suspicion: Value; Transaction Speed, Inconsistency]

Mary explained that in order to write an offer, Jane would have to provide a deposit and ID. At this point, Jane e-mailed Mary and unexpectedly informed her that her brother was actually going to mortgage the house because he would be living with them (anonymity - last-minute third party).

Mary offered to make the 45-minute journey to meet them and draw up the offer, however Jane asked that she be emailed the form with the buyer's name blank so that she could enter the brother's name (anonymity). Her brother would arrive from Iran (geography) later (May1 ) and fill in the details then or earlier by e-mail exchange (anonymity).

With suspicions mounting, Mary explained that the brother's ID would have to be checked personally. She offered to collect the deposit cheque and validate her brother's ID at the same time. Mary also requested information on the lawyer and the bank, as part of the standard financing and legal steps.

Jane explained that they preferred to send the deposit check by mail because the restaurant's working hours were unpredictable (anonymity).

Accompanied by the deposit check signed by her brother on April 25 (several days before her arrival - inconsistency), Jane faxed a copy of her brother's driver's license (anonymously) and provided only a mortgage pre-approval without any of the required details.

When Mary called Jane and began to explain once again that the brother's identification document would have to be validated in person in order to proceed, Jane became very defensive and threatened to find another real estate agent. At this point, Mary explained that without proper ID validation, it would not be possible to close the deal. Jane informed Mary that her brother had decided to cancel the deal and requested that her brother's deposit be credited back to his (defaulting) bank account. Due to the overall level of suspicion raised by the combination of observable elements linked to the indications of suspicion, a declaration of suspicion was submitted to the competent authorities

This case study, shared by the FATF, shows that professionals in the real estate sector, as well as all other regulated professionals involved in the transaction, need additional sensors to detect suspicions of money laundering.

According to TRACFIN, certain non-exhaustive criteria can be used to support the analysis of a suspicion:

- the prestige real estate sector in exposed areas of the country (Île-de-France and Côte d'Azur in particular);

- VEFA(vente en l'état futur d'achèvement) sector;

- Use of international financial arrangements involving companies registered in high-risk countries AML-CFT ;

- use of fictitious or falsified identities;

- inconsistency between the customer's financial situation and the amount of the loan obtained or the amount of the investment made;

- presence of a politically exposed person (PEP) in a scheme designed to conceal his identity;

The FATF identifies and summarizes several activities that may be indicative of money laundering via the real estate sector:

- Use of complex loans or credit financing,

- Use of non-financial professionals,

- Use of complex structures,

- Unexplained use of virtual assets,

- Manipulation/Inconsistency of property valuation,

- Use of monetary instruments,

- Inconsistency between estimated capital gains and property renovation work,

- Use and purchase of commercial properties incompatible with the buyer's business,

- Use of mortgage plans,

- Use of investment programs and financial institutions,

- Use of properties to conceal money generated by illegal activities,

What checks should real estate professionals carry out?

Right from the start of the relationship, and therefore well before the real estate transaction takes place, initial due diligence involves more than just customer (buyer and/or seller) verification processes. The professions subject to AML-CFT obligationsmust gather and evaluate all relevant information to ensure that they :

- Can verify the identity of each customer, of those who claim to act on their behalf and/or of the Beneficial Owners.

- Have taken all necessary steps to determine the identity of the beneficial owner.

- Have a full understanding of the customer's situation and business, and the expected nature of transactions, including their ad hoc nature.

- Include source of funds.

- Identify whether a stakeholder is considered a sensitive person (person under international sanction, politically exposed person or close to a politician, person with a bad reputation (Adverse Media), person linked to a country under vigilance or embargo, etc.).

Following these initial checks, the regulated professional can establish a degree of risk AML-CFT.

A real estate company should consider a high risk of money laundering or terrorist financing when any of the geographic, customer and/or transactional risks listed above are present, but particularly when:

- Customers have links with high-risk jurisdictions.

- The customer is a PEP (Politically Exposed Person) or a family member or close associate of a PEP.

- Complex ownership structures are deliberately used to obscure the acquisition.

- The real estate professional has not received adequate information from the customer and must :

- Take reasonable steps to establish the source of wealth or income.

- Request additional information about the customer, including further information about initial due diligence where concerns have arisen about the veracity or adequacy of previously obtained information.

- Customers are involved in cash-sensitive activities or request settlement with cash and/or virtual assets without transparency of the payment source.

When customers and transactions represent a lower degree of risk AML-CFT, the regulated professional can implement simplified due diligence.

However, the argumentation and evidence gathered to establish a lower risk must be clearly documented in the reporting firm's policies and procedures. Reporting professionals must also ensure that they have obtained sufficient information to enable them to be reasonably satisfied that the risk of AML-CFT associated with the relationship is low-risk.

A simplified procedure may include:

- Modification of the scope of information required for identification or verification for surveillance purposes.

- Change the quality or source of information obtained for identification or verification by accepting information obtained from the customer rather than an independent source.

- manaebusiness92@gmail.com

Finally, the implementation of a simplified procedure does not exempt any real estate company from reporting any suspicious transactions.

Where customers and/or transactions represent a high degree of risk AML-CFT, the regulated professional is obliged to implement enhanced due diligence.

This implies greater scrutiny of the source of funds and the purpose of the transaction. For the fight against money laundering and the financing of terrorism, the source of funds is an important factor in the overall risk, and is often only mitigated by obtaining sufficient information/documentation to verify the source of funds. This is all the more important when you consider that most real estate transactions are one-offs, and cannot be monitored on an ongoing basis.

How to meet your obligations AML-CFT

There are three main ways to meet your obligations as a real estate agent under AML-CFT :

- Train your teams,

- Implement a risk assessment and management system,

- Report your suspicions to Tracfin.

Team training involves updating knowledge of the risks incurred by professionals involved in financial transactions. Tracfin e-learning training modules are available to share with employees. Employees must also be aware of the risk assessment and management procedure established within your organization.

Setting up an assessment system is more complex. It involves mapping the risks associated with your business and the customer profiles you deal with, so as to identify the different levels of vigilance and the appropriate behaviors.

You need to define internal protocols to identify at-risk customer typologies, pinpoint the categories of transactions that could give rise to suspicion, and verify the persons and origin of the funds injected into a transaction.

Conclusion

While your teams' training obligations are relatively straightforward, setting up an assessment system becomes complex when it comes to detecting and verifying lists of sanctions on sensitive persons, asset freezes, Beneficial Owners, PEP (Politically Exposed Persons and their close relations)... This is a time-consuming task that would be impossible for you to carry out manually, given the millions of names under lists to be reconciled with your prospect/customer base. Yet this is one of your major obligations to comply with AML-CFT regulations.

Comply with regulatory obligations to detect sensitive persons (Sanctions, Asset freezes, etc.), PEP and their relatives, reputational risks, country risks...) thanks to the SaaS APScan solution.

This turnkey productautomates your entire detectionprocess and makes it easy to manage alerts.

Detection is carried out instantaneously on entering into a relationship, and periodically on your entire database of Third Parties (natural and legal persons).

Thanks toa state-of-the-art reduction engine, you can limit false-positive alerts and accelerate your business.

Configuration is in No-Code and available through the Compliance Officer's own interface. All actions are traced/explained and exportable via reports.